U.S. Bank, recognized for its ethics, social responsibility, and inclusive culture becomes the latest financial institution to collaborate with us here at Project Access in our Adopt a Resource Center program. This innovative initiative offers skills development, financial education, and other resources for residents of affordable rental communities across the nation.

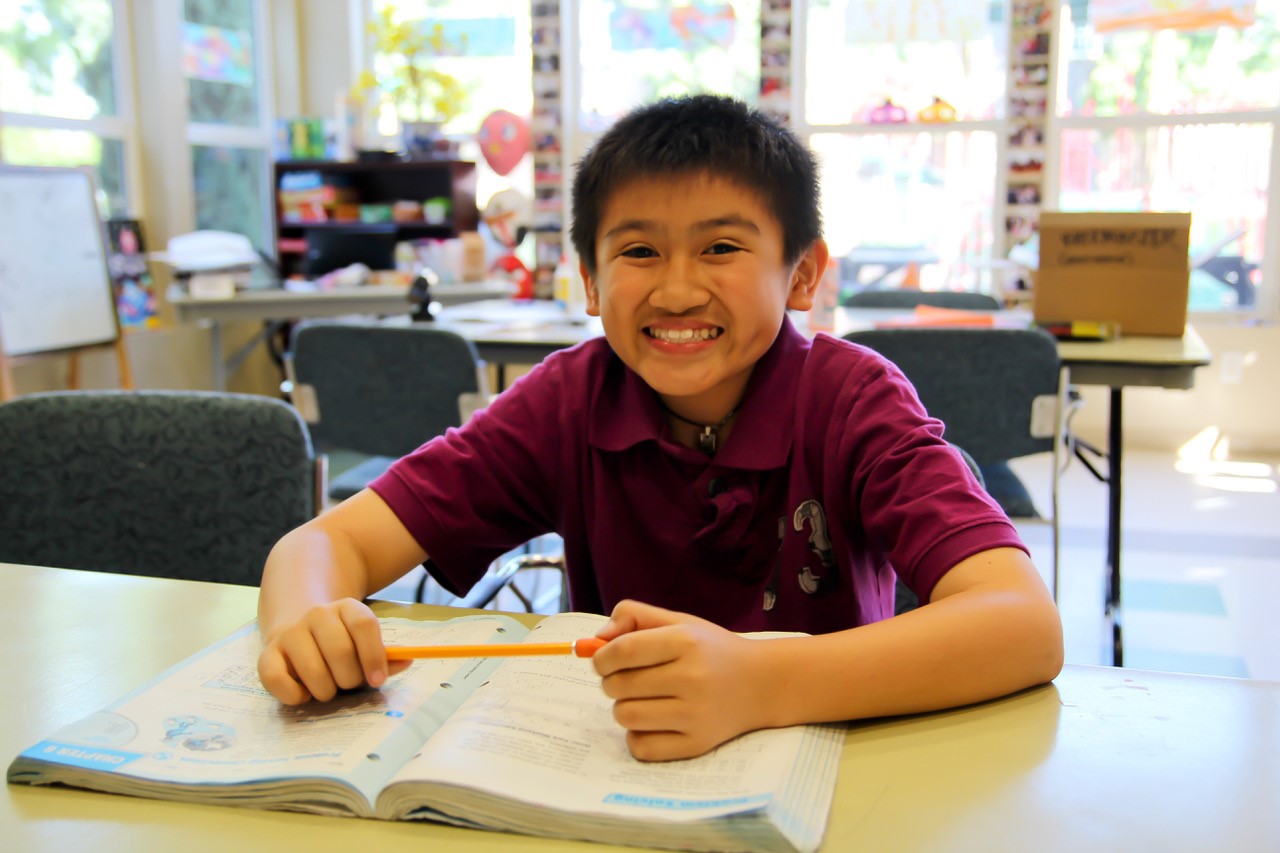

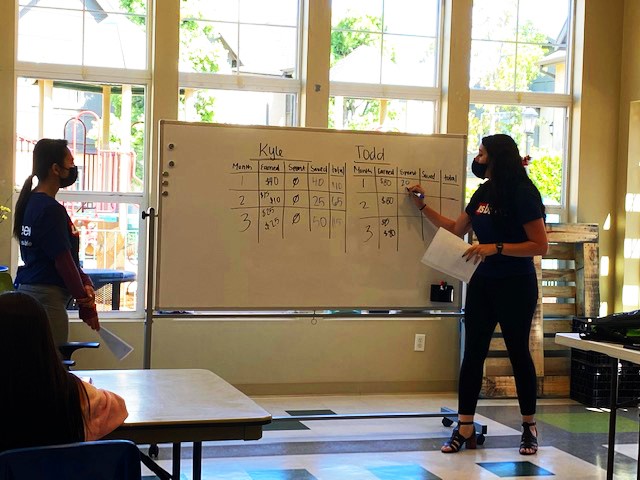

With this grant award, U.S. Bank “adopted” Windsor Court/Stratford Place Apartments in Westminster, California, and will assist Project Access in helping residents create a safer, more cohesive community. In addition to providing funding that will help with skill building and workforce training, U.S. bank employees will help lead financial education workshops tailored to youth and adults, as well as participate in other volunteer opportunities focused on enriching and supporting residents.

This approach to service delivery embeds Project Access into the fabric of a community, allowing the non-profit to build trust with its residents while also eliminating significant service barriers like transportation, childcare, and cost. In 2020, Project Access reached more than 22,500 residents. “This collaboration with U.S. Bank at our Windsor Court/Stratford Place in Westminster is a great example of how the public and private sectors can come together to benefit their respective communities,” states Kristin Byrnes, Project Access CEO and President.

At U.S. Bank, philanthropy is an important catalyst for helping to create positive change and focuses on identifying organizations who are addressing systemic and structural barriers to success for women, diverse communities, and low-to-moderate income neighborhoods. Through its “Community Possible” pillars of “Work, Home and Play” U.S. Bank is providing grants in all three areas to address racial, social, and economic inequities: supporting small businesses, creating housing, and connecting communities through arts, culture, and recreation.

“U.S. Bank is honored to be a part of Project Access’ Adopt a Resource Center program, especially the opportunity to offer financial education workshops for youth and adults, says Chris Venhoff, U.S. Bank’s Orange County Consumer and Business Banking Leader. “We believe in making community possible by providing tools and resources to help stabilize and empower households in the most accessible ways,”